In March and April 2025 I was fortunate enough to spend a month in Canberra as a visiting fellow at The Australian National University’s prestigious Research School for Social Sciences. Fine colleagues in the School of Sociology made me welcome and Canberra delighted me, with its lake, trees and hot air balloons. But a highlight was a public lecture I gave on 26 March 2025, recorded by ABC National, and I’m sharing the script here. The radio recording precluded slides, so I’ll add in some images that I might have used. Enjoy!

Update! The lecture was brodcast on ABC National in October. You’ll find it here!

Good evening, thank you all for coming tonight, and for that generous introduction. I’d like to thank the Research School for Social Sciences for offering me a fellowship, and the chance to spend a month in Canberra; to the Journal of Cultural Economy for the not inconsiderable contribution of getting me here; and to colleagues in the department of sociology and the department of management for the warm welcome that I have received over the last weeks. Thank you also to ABC Radio National for recording this lecture.

I too would like to acknowledge that we are meeting on land belonging to the Ngunnawal (Nunnawal) and Ngambri (nambri) people, to recognise that sovereignty was never ceded, and to pay respect to their Elders past and present.

The acknowledgement of country seems to me, a visitor from the other side of the world, a welcome recognition and acceptance of the difficult history of colonialism. In that same spirit of recognition, I would like to take you from a massacre to a legal trial and a personal connection to the murky history of finance, which can – should you wish – be told as a history of colonial exploitation. Indeed, even if you don’t wish, it still must be.

There was a massacre at sea. In 1781. Luke Collingwood, captain of the slave ship Zong, ordered the drowning of 133 of his captives. It’s a scene evoked in William Turner’s unforgettable painting The Slave Ship, a swirling mass of colour and rage, held together by a lowering sun. In the foreground, horror: manacles, limbs, hideous fish and birds.

There are few historical sources for the massacre. There’s the dossier compiled by the abolitionist Granville Sharp which helped to galvanise the public to the cause. And there’s a record of a legal case. Not a murder trial, but a civil case, ‘Gregson versus Gilbert’. The massacre became the basis of an insurance claim, and when the underwriters refused to pay, the slavers – the Gregsons – took them to court. The compiler of the legal records was a barrister and a legal scholar, a member of London’s Inner Temple. His name was Henry Roscoe.

To tell the story of ‘Gregson v Gilbert’ is to go back to the commercial world that developed at an astonishing speed during the eighteenth century, centring on Liverpool, a provincial market town in north-west England, which by the end of the century could consider itself one of the world’s leading economic and cultural cities. Gregson’s own career epitomizes this transformation. He started out a ropemaker but rose to be one of Liverpool’s most distinguished citizens, becoming mayor in 1762. And he was the most rapacious of all. During his career he invested in 152 voyages, shipping to America a total of 58,201 Africans, of whom 49,053 survived. By that account – and we shall return to accounts shortly – 9,148 perished.

Slaves never travelled through Liverpool. Liverpool’s slaving was a financial endeavour, a sanitized mirror-world of lists and ledgers. The Liverpool merchants – and lawyers and bankers – invented a system of credit that allowed them not only to greatly speed up the circulation of capital around the slave triangle, but also to benefit from interest on that capital as it flowed. They began to use bills of exchange. These were not a new technology, but the Liverpool innovation was to tie these financial instruments to human souls, transforming a trade in obscene commodities to a sanitized and swift trade in loans. The bills, like modern bonds, circulated among investors at a discount to face value; the city’s banks flourished, and the bonds travelled widely, soon taken for payment at the slave factories on the coast of Africa. Capital fed upon itself. Many bonds offered three years of credit, and in boom time three years is practically forever. The slaves, writes Ian Baucom, the scholar who unearthed this practice of financing, ‘functioned in this system simultaneously as commodities for sale and as the reserve deposits of a loosely organized, decentred, but vast trans-Atlantic banking system: deposits made at the moment of sale and instantly reconverted into short-term bonds.’

Slavery powered the economy of north-west England, and everyone knew it. Those commissioning and designing Liverpool’s new Exchange building did not shy away from this fact, decorating its exterior with a frieze of African heads. As commerce boomed, so the city enjoyed an explosion of culture. It became international in outlook as well as trade; the Exchange building’s piazzas of white stone were just one expression of a growing fascination for all things Italian. Liverpool’s cultural transformation was led by one man. He was William Roscoe, father of Henry Roscoe, barrister and transcriber of the Zong hearing, and great-grandfather of my great-grandfather.

Unlike William Gregson, who left few traces in the archives, Roscoe was famous. He is now remembered as one of the city’s founding fathers, commemorated in plaques, street names, and a fine little pub called the Roscoe Head. He was a leading intellectual figure: his biography of Lorenzo d’ Medici brought him admiration from Horace Walpole and comparisons with Gibbon. He wrote a children’s poem (originally for my great-grandfather’s grandfather), titled ‘The Butterfly’s Ball,’ which was admired by King George. He was known most of all as a leading abolitionist, author of long poems deploring the trade, and someone who voted for the abolition of slavery despite his role as member of parliament for Liverpool.

And yet. Roscoe’s first profession was that of lawyer and by the age of 46 he had made enough money to retire to Allerton Hall, a stately home outside the city. His art collection included a painting by the unfashionable Leonardo da Vinci. In the year 1800, he took up a partnership in a distressed banking firm run by his friend Thomas Clark and set about righting it. What did he bank? What contracts did he draw up? Liverpool’s economic engine ran on slavery. My grandparents’ stories of the abolitionist ancestor sit uncomfortably with this fact: his money would have been new, and very, very dirty.

An illusion of cleanliness allowed Liverpool to be the nursery of the classical renaissance in Britain. It depended upon acts of separation and of representation. Slaves existed simultaneously in two places, as bodies in the stinking, corporeal holds of the gaol ships and as tallies – spectres, in Baucom’s terms – in the clean and disembodied realm of accounting ledgers. They represented two kinds of value: one of embodied labour not yet exploited, and the other a speculative financial value that rested on the Gregsons’ balance sheet until it could be realized at auction in the Americas. Their speculative value was locked into place by insurance, another financial technology closely related to the social networks and the financial institutions of the city.

Insurance takes us to the heart of the Zong massacre. As Captain Collingwood, incompetent or deranged, or both, found himself unlikely to land a cargo of slaves, he sought to crystalize that speculative value by murder. If the slaves had died of natural causes, or landed sick and unsaleable, it would have resulted in a loss for Gregson’s syndicate. But by the maritime insurance principle of ‘general average’, if part of the cargo had to be jettisoned to save the ship, all stakeholders would pay their share. And so, on the flimsy justification of navigational error and water shortage, he instructed his crew to hurl overboard one hundred and thirty-three men. It took three days, even if the final ten, grasping what little agency they had left, chose to throw themselves voluntarily into the ocean. Captain Collingwood’s actions cleaned up the embodied – traumatised, sick and filthy – aspect of these persons cum commodities, catapulting them headlong into the realm of speculative value, of capital already made real by the insurance contract.

I’m not telling you this episode to insist that finance is always already awful. But it does have a powerful urge to extract, and the Zong is the very worst of it. It is in its bones, even today. Insurance, for example, played a crucial role in solidifying the speculative value that powered the 2008 financial crisis. Unlike the Gregsons’ policy, the bankers’ insurance came good. The US government injected $182.5 billion into AIG which paid out to Wall Street creditors at 100 cents in the dollar. This was a direct transfer of taxpayer’s money to the richest stratum of society. Those who suffered were disproportionately poor, Black, Latino, and migrant. These are the go-to victims of financial exploitation, whether that’s in the case of the financial crisis, the British Malay rubber plantations of the early 20th century, the Canadian ‘moms and pops’ investors blown up by the Bre-X scandal, or the many losers in the proliferating scam economy that is cryptocurrency.

The point I would like to make is a more subtle one, that finance is a social technology. It is a cluster of practices, instruments, technologies, and ways of thinking and doing that emerged organically with modernity, industry and the modern nation state. It is, in many ways, a mirror of where we are as a society. The stock exchange stands at the centre of this relationship, a fulcrum through which the leverage of capital can be exerted. So, in 1697, London’s stock exchange came into being as state met capital and a crowd of buyers and sellers. The new parliamentary nation needed cash to wage its war against France and found it by borrowing from the joint stock corporations. These were the early military industrial instruments of colonization like the East India Company, which, in return for the loans, received licences to monopolise certain territories. They financed the loans through issuing stock. Some of the city’s commodity traders, or jobbers, became stock jobbers and maintained a market in these corporations’ stock, liquifying the national debt and forming a mutually enriching conduit between the needy exchequer and the bulging pockets of the merchants. It’s all tangled up, from the very beginning. The trade in financial imaginaries took a lot of getting used to: Dr Johnson’s dictionary dismissed the stockjobbers as low wretches buying and selling in the funds. But, as the slavers’ notes show us, it’s amazing what we can get used to, especially if the unpleasantness is somewhere else, scraped clean by the financial technologies of bill, account, and contract.

As a social technology, finance needs constant maintenance and reworking if it is to continue in existence. And this means that it is malleable in a way that one might not necessarily think as one gazes at the solid, rusticated stone of the New York stock exchange, or watches news headlines about markets bringing down governments. There is nothing inevitable, or inexorable about the present and future state of finance; we have made it, and we can remake it or unmake it as we see fit. What we choose to do is a political choice.

I must confess now that the title of this talk – and my book – is somewhat mischievous. It is a how to that never tells you how to. My apologies to anyone in the room wondering how to get their crypto exchange hustle off the ground – there’s nothing for you tonight. Instead I try and sketch out the conditions of possibility that give rise to financial institutions in general, and stock exchanges in particular. In the book, the stock exchange is both a synecdoche for finance as a whole, and the engine that powers the narrative. I tell the story of the formation, in mid-1990s London, of two stock markets, both dedicated to the shares of smaller, ‘growing’ companies: the London stock exchange’s AIM, and the private endeavour OFEX. Their conditions of possibility entailed dense social relationships among communities of practitioners, technological innovation, and underlying political transformations between market and state. The markets – and financial institutions more generally – are the product of all of these things mixed up with the often-contradictory personal projects of individuals and groups. It’s more a case of how to un-build a stock exchange, how to open the box and see what’s inside; how to disassemble, in the words of the late Bruno Latour, this institution that seems so normal, so natural, so much part of our world.

Social relations first of all. Let’s step back to a different time. Imagine an enormous room, capped by a vast dome. At one hundred feet in height and 70 feet in diameter it was said to be of a kind with the basilicas of St Peter in Rome and St Paul in London. This was the great trading room of the London Stock Exchange, known as the Old House. A blue-mottled marble faced its walls and pillars, and the wags called it ‘Gorgonzola Hall’ after the cheese. There was not much furniture, just a few rickety shelves and throughout the hall ramshackle chalkboards covered in numbers. Each firm of jobbers occupied a particular spot on the Exchange floor, where the chalkboards marked their ‘pitch’, while the brokers spent market hours in their ‘boxes’ at the edge of the floor. Business stayed in the family, and these pitches and boxes often passed from father to son. During trading hours as many as 3000 men jostled under the dome, manning these pitches or circulating through the crowds. Images show men in dark suits and ties, men in white shirts, hatless, men in an attitude of ease, men standing in groups, men chatting or strolling. There were games and pranks. When business was slow, on a Friday afternoon, songs would burst out: the jobbers would sing the Marseillaise to a supposedly French colleague and slam their desk lids – the clerks had old fashioned schoolroom desks – as cannon. Three thousand male voices raised in song together, echoing under the dome: noise, camaraderie and xenophobic ‘banter’. A bygone age, a different world.

How long ago? Not that long. The Old House closed in 1966, the same year that England last won the soccer world cup.

The Exchange had an apprentice-based career system that welcomed cockney sparrows as well as the younger sons of the old elite. Boys from the East End rubbed shoulders with graduates of august Oxbridge colleges: ‘I like talking to you’, an old jobber told one young Balliol man, ‘‘cos you’re the only bloke in the market, wot I talk to, wot talks proper.’ Meritocracy survived because trading was so impossibly demanding. Brokers and jobbers circulated in the hall, trading face-to-face according to a complicated verbal etiquette. Prices could be quoted in fractions of a pound, ‘seven fifteen-sixteenths to over the figure … a very complicated effort’, says one. Dealing was, until 1971, conducted in pounds, shillings (s) and pence (d), making already complex arithmetic devilishly so.

The possibility of meritocratic success did not extend to women, however. In 1966 – the same year that the Old House was closed – a Miss Muriel Bailey, highly commended brokers’ clerk, sought membership of the Exchange in order to apply for position as partner in her firm. To be a partner, one had to be a member, and to be a member, one had to be a man. Miss Bailey, who had run one broker’s office throughout the Second World War and in subsequent years had built a substantial client list, considered this an unreasonable obstacle and applied for membership all the same. The Council of the Stock Exchange agreed to support her application so long as she promised not to set foot upon the trading floor, but the membership resoundingly rejected this proposal. That was in 1967. At least the membership proved to be consistent in its bigotry, in 1969 rejecting the membership of foreigners, and voting against the admittance of women again in 1971. Only in January 1973 did the membership consent to allowing female clerks to become members. Miss Bailey, by now Mrs Wood, was finally elected aged 66.

There is something of the sacred and profane about these exclusions – particularly the suggestion that Miss Bailey should not tread upon the hallowed ground of the trading floor. Those men who wished to join the priestly order of jobbers had to serve a lengthy apprenticeship, working through clerical and junior status until eventually they became a dealer, then partner. Brian Winterflood – a central character in our story – was one such lad.

Winterflood, who died in the summer of 2023, was a legendary figure in the smaller company market world. His career tracked the markets’ ups and down more closely than anyone; his name is, in fact, almost synonymous with small company trading. Like all would-be jobbers, Winterflood began as a messenger, then a ‘red button’ and a ‘blue button’, each colour of badge denoting an increased level of seniority and certain powers and responsibilities. Eventually, one might become a dealer, authorised to trade with the firm’s money. Often there was a ceremonial moment of appointment, but none such for Winterflood. ‘I had a particularly nasty senior partner’, he remembers. ‘He was a moody so-and-so and he used to gamble every day on the horses, his life was terrible, he ran off with another woman. The day that I got authorized to go on to the floor of the Exchange, he puts his hand in his pocket … and he says, ‘All right Winterflood, now you are authorized’, and he took his hand out like that and he gave it to me, it was my badge, my authorized badge. And he said, ‘Mind your ahem eye…’ [expletive deleted for radio]

Times were hard in the mid-60s and 70s as the Exchange languished in its role as regulatory arm of an interventionist government. There was little demand for trade; returns on Government debt were so high that equities did not seem worth the bother. Members held other jobs and scrabbled to make ends meet. Winterflood and his wife ran a small bric-a-brac shop named Fludds in Valance Road, at the end of Petticoat Lane. Others did worse: Winterflood recalls meeting a colleague selling carpet squares – ‘not even whole carpets, carpet squares!’ Jobbers would talk about making their daily ‘two and six’, the cost of the train journey to work and home again.

In January 2017, just after his 80th birthday, Brian Winterflood rang the Stock Exchange bell to call time on his career. The man who ran a bric-a-brac shop to make ends meet retired a multimillionaire, able to charter a private jet to his holiday home in Corsica or spend the winter in a Floridian holiday village where there is line dancing every evening. Winterflood Securities – Wins – the firm that he founded and sold in the early 1990s but ran for many years after, is reported to have made £100 million in 2000.

(www.fnlondon.com)

Something had changed, and we can pinpoint the date more exactly, to late 1984. John Jenkins, the founder of OFEX – that’s one of the two exchanges I look at – is another central character in my narrative. He spoke fondly of his days matching bargains in the early 80s, making a grand a day… A thousand pounds, In those days, he said. In 1984 John’s firm, S&J Jenkins Ltd, the smallest firm of jobbers on the exchange, made £1 million in five minutes of trading; in 1986 it sold out to investment bank Guinness Mahon, and in October 1987 the firm – now a trading desk in a global bank – lost £10 million in a day’s trading and clawed most of it back over the following few.

The transformations of the 1980s are too complicated to do justice in a short lecture. The old, post-war economic order simply disintegrated under the pressure of oil shock and global capital. Britain abandoned exchange controls, and global banks moved into London to take advantage of the unregulated Eurodollar markets; even the Soviets joined in, with $60 billion deposited in safety and anonymity. The giant public offers of national firms – beginning with British Telecom in December 1984 – gave rise to a new kind of market participant, the everyman private investor whom the television commercials named Sid. Sid hoped to make a few hundred quid from the public offers. The jobbers did rather better: it was the BT issue that made S&J Jenkins its five minute million.

All this came to a head in the reforms known as Big Bang, Monday 27 October 1986. The new regulations abolished the role of jobber and London’s single capacity dealing and opened the door to members from overseas. Now the treasure chest that 1980s London had become lay open to all. It offered a bridgehead for US firms looking eastward and European or Australasian firms looking west. Here was an opportunity to gain entry to the august London Stock Exchange, a closed shop for 200 years. The easiest way to get a seat on the Exchange was to buy a firm that already owned a membership, and bidders circled. Foreign buyers found the jobbers with ledgers fattened by the profits of these public issues and snapped them up at inflated prices. Hoare Govett, the queen’s broker, most gilded of the gilt-edged, was sold early on to Security Pacific, not just a US firm, but one from Los Angeles with interests in ‘real estate’, of all things. Even if the amount offered did leave ‘pound signs bouncing up and down behind the eyeballs’.

It took the jobbers by surprise, and the brokers too. ‘1980 was a very difficult period …’ stockbroker Andrew Beeson told me. ‘Four years later, suddenly someone was going to pay us £11 million. You know, [pay] all the partners for this business and we thought that Christmas had come.’ Note Beeson’s phrasing: ‘pay all the partners’. Not the staff or the shareholders, but those who happened to be standing at the top of the escalator in October 1986. Big Bang did more than dismantle a system that had been in place for 200 years. It completely destroyed the social infrastructure of the City. The old firms had run on the partnership model. Jobbers traded with the bosses’ money; they had to ‘mind their eye’ and wince inwardly as the partners ran their careful fingers down each day’s tally. Apprentices earned little but could work up the ladder to a seat on the Exchange and a place in the partnership where they would be comfortable, secure and one day even wealthy. Everyone’s interests were focused on the long term: if the firm went broke, everyone lost.

Big Bang tore this apart. The partners became rich overnight and took with them the spoils that might have gone to future partners. There was no longer any reward in long service. Time-served dealers drifted away and youngsters, often with university educations, ruled the roost. They traded long hours at screens before dashing to exclusive wine bars or the BMW dealership. The bonus culture replaced the partnership culture, and institutional memories of harder days faded quickly or simply walked out of the building. These youngsters soon forgot, or perhaps never learned, the adage that prices can go down as well as up.

The great bull run of the 1980s came to sudden end on Black Monday, 19 October 1987, a day of almost Shakespearean destruction when a hurricane tore through southern England, prices tumbled, and market screens stopped working. For these were the other enormous innovation of Big Bang, the culmination of decades of technical progress by the engineers at the exchange, who launched a system called the SEAQ or stock exchange automated quotation.

The engineers, who had been treated as second-class citizens by the exchange’s members advanced a different vision of what a market could look like: coloured numbers on a screen, a market distributed across networks of cables and accessed from offices. The trigger screen showed the whole market in a single place, its changing colours giving a picture of the action at any moment. We are talking about teletext type screens here – younger members of the audience might not even remember what these looked like – but this was a radical idea and it finished the trading floor for good. ‘Within five minutes of Big Bang’, said one participant, ‘on Monday morning, it was clear to me that the floor was dead. I’m not bragging. I was the last person in the City to figure it out.’ Suddenly the engineers were in charge.

What is less known is that the LSE also launched a screen that they called non-SEAQ. This is where you could find prices in unquoted stocks traded under a peculiar regulatory exemption called Rule 163. And this matters because, on 11 February 1991, John Jenkins – him of the five minute million – and his former blue button Paul Brown set up a small firm to trade Rule 163 stocks over the counter. At some point in the early 90s the firm took over the operation of this non-SEAQ board, and formed a joint venture with Reuters to disseminate news and price information through a primitive vehicle called News track. In 1995, the London Stock Exchange closed the non-SEAQ board and the Rule 163 exemption. It had been under pressure from Winterflood, Beeson and others to open a smaller company market, and it was worried about Jenkins’ entrepreneurial adventures conducted under its own regulatory aegis. Closing the exemption rolled the trade into a new market the LSE was launching, called AIM. But not every stock could move, or desired to do so. Jenkins, who by this point had a decent business going, had no option but to set up his own trading venue. He called it OFEX, for off exchange.

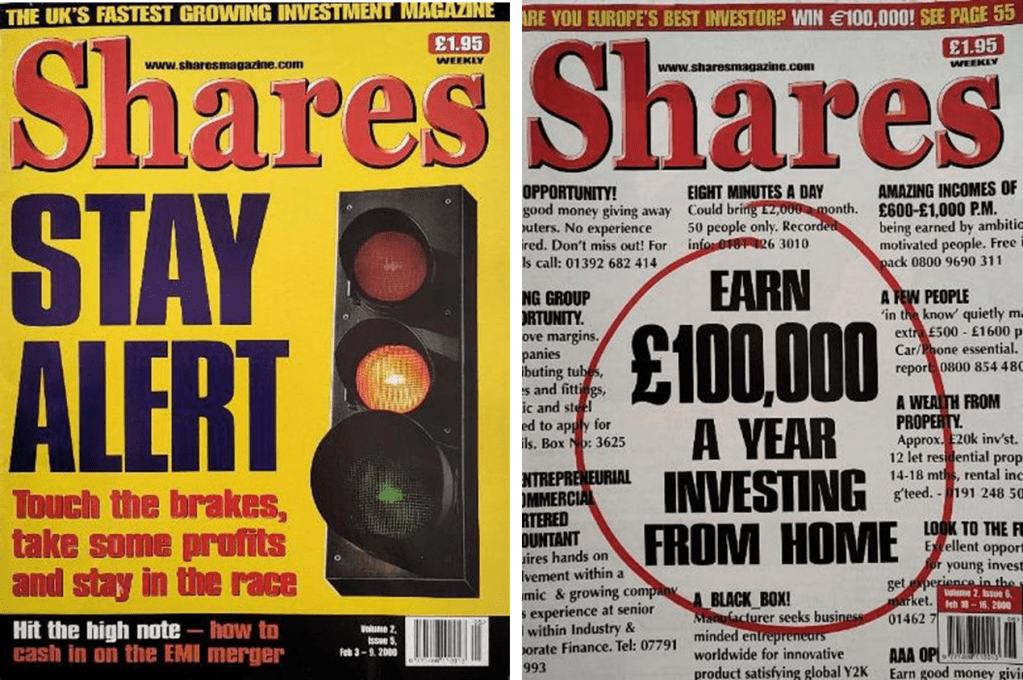

I first encountered OFEX in the summer of 1999. I was a young reporter at the newly formed Shares Magazine. Shares, as it was more usually known, had been set up early in 1999. It was fronted by Ross Greenwood, who you may know as one of the country’s leading finance journalists, but was then, to me, a cheerful, kind-hearted Australian, at the time taking a sabbatical in London. Shares was not an intellectually demanding publication. As hordes of punters rushed to find their little piece of the dotcom magic, copies of the magazine flew off the shelves and the publishers, tough veterans of trade magazines and commercial advertising sales, rubbed their hands with glee. Their only problem was getting the staff. Not just competent staff, but anybody at all. I emerged blinking from a long stint in university libraries to find the British economy in overdrive, my friends racing around in cobra-striped hatchbacks, hopping from job to job with abandon. I attended an undemanding interview, after which, with a desperation born of economic ambition and organizational crisis, Shares Magazine hired me.

I liked the job. I liked the deal it came with even more: being handed the first gin and tonic as the hour hand crept towards one; riding across London in the back of a black Mercedes, on the way to air my views in a television studio at Bloomberg or the Money Channel; the buzz of young colleagues and new technology and the sense that the world was changing for the better. I liked the fact that a mysterious woman called Bella, whom I never met, used to telephone me regularly for syndicated radio news bulletins that I was never up early enough to hear. [don’t!] Most of all, I liked the smell of money being made and believed that somehow, in a small way, some of it could be mine.

Daniel Defoe wrote of ‘projects’ – start-ups, or entrepreneurial endeavours, we might call them – as ‘vast undertakings, too big to be managed, therefore likely to come to nothing’. He could well have been describing the late 1990s, as the dream of the ‘world wide web’ finally arrived. These were years rich with ‘the humour of invention’, which produced ‘new contrivances, engines, and projects to get money’. The technology was still rudimentary. If you wanted to ‘go on the web’ at home, you plugged a computer cable into the phone socket and listened to beeps and wheezes as the connection dialled up. But a wide-open and networked future beckoned and stock markets were banking those future profits right now. Every Sid and Sandra, recovered from the wounds of 1987, was piling into the market. Stocks were on the news and chatted about by taxi drivers; everyone hoped to get a piece of the next dotcom sensation. OFEX itself had connected to the web and offered everyday punters access to prices in real time – a remarkable feat considering that eight years earlier it had been circulating typed catalogues.

It wasn’t surprising that I couldn’t see what was what in this bizarre dotcom world, where 25-year-olds could move markets and people followed them with their life savings. Everything seemed new, and everything was madness: firms that had existed for weeks, with no products or sales, now worth millions; two-bit corporate finance outfits ranked more highly than industrial concerns. One mid-size broking and advisory firm, Durlacher – a newish outfit, although one that carried an esteemed City name – saw its market value climb enough for it to qualify for the FTSE 100. ‘In January 2000’, one small-time financier told me, ‘one of my colleagues came to me and said, “I’ve just worked out what your options are worth….” In January 2000, my personal options, according to my colleague, were worth substantial double figures of millions. I’m glad I didn’t go out and spend it….’

OFEX became a reliable venue for raising money, often for very speculative ventures: a firm called printpotato.com, set to revolutionize t-shirt printing via the internet, or, if my memory serves me well, balls.com, the ‘one-stop shop online’ for anything ball-related. There was the wittily titled ‘E-male order’ [that’s M-A-L-E], setting out to capture what was, in 1999, regrettably still called the ‘pink pound’. The crucial device for all these fundraisings was the prospectus, a 60-page A4 booklet jammed with legal boilerplate. The financiers assembling them did not have a legal protocol to follow so they repurposed the offer documents of more senior exchanges. Offer rules were based on caveat emptor – buyer beware – so however imaginative the offer might be, it need only be displayed in the prospectus and buyers were expected to discriminate accordingly. On the back page, a tear-off slip invited anyone inclined to send in a cheque.

How did the public find out about these exciting new offers? That is where we, the media circus, came in. Young, literally hungry journalists, and canny public relations firms, formed an interface between the company raising millions to fill a warehouse with tennis balls and the investors who hoped to be a part of the brave new dotcom world. The PR executives operated a simple formula, described by one as ‘If I take you [journalists] out and get you a lot to drink you’ll write about my company’. As recent graduates, we were ideal candidates: we may not have known much about stock analysis, but we were true experts on free booze. Yet there was more nuance to this strategy than first appeared. The rule was to keep the journalists at lunch until late in the afternoon so they had no time to do any research and, cushioned by a warm cloud of claret and sirloin, would write the story as it had been passed to them. There was a fine line between good-natured inebriation and incapacity, so it was the task of the host to send the journalist back to the office while they could still write; 4.30 pm was widely held to be the ideal breaking-up time, leaving the hack foggy-eyed at the screen rewording press releases for a deadline. The cost of all this hospitality fell on the future investors, although I remember one story about a firm that went bust at the mere thought of the restaurant bill, leaving the PR man to pick up the damage and the tab. This same man, a ruby-faced, genial version of Monty Python’s Mr Creosote, passed away just a few years ago in his grand residence in the south of France, until his late 80s a living reprimand to all things health and diet-related.

But the formula worked. The extraordinary demand for stock threatened to overwhelm the small finance firms: ‘There was one particular day’, a financier told me, when I personally fielded over 300 phone calls. My receptionist logged 275 phone calls that she couldn’t put through to me, because I was on the phone … they were almost always all the same, ‘Did I get a piece in your last float, can you put me down for the next one?’… On a Sunday, phones rang all day long, people in the hope of getting somebody on the line that they could give money to.’

Not everyone agreed that dotcoms were worth what was claimed. There was a very public spat between two Wall Street analysts concerning a strange new company called Amazon. Jonathan Cohen, a well-regarded analyst at Merrill Lynch, argued that Amazon should be valued as a bookseller and forecast $50 a share. Henry Blodget, an unknown newcomer at a Canadian bank, called Amazon an ‘Internet company’ – some other kind of thing – and predicted $400 a share. There is a double epitaph here: Blodget became Merrill’s star tech analyst but was completely discredited when regulators discovered that he had been selling his audience duds. He had publicly rated one, excite@home, as a ‘short-term accumulate’ while telling colleagues that it was ‘such a piece of you know what’. He was fined heavily by the regulator and his Wall Street career was over. As far as Amazon was concerned, however, Blodget was right. Amazon really was some other kind of thing, and its current share price makes his target seem entirely insignificant. Blodget too came out of the woods, founding Business Insider which he sold for $343m in 2015, so it wasn’t all bad.

In dotcom London, the role of super-aggressive tech analyst went to one Dru Edmonstone of not-quite-FTSE100 dotcom powerhouse Durlacher. When I returned to academia I thought I had heard the last of him, but in a story that amused and delighted the editors of serious news outlets, Edmonstone – a distant cousin of the Queen Consort – was in 2018 found guilty of fraud. He had, inter alia, claimed various welfare payments under the names of his sister, of an employee of his father, Sir Archibald Edmonstone, the 83-year-old 7th baronet of Duntreath, and of Fight Club’s Tyler Durden. He had masqueraded as a doctor to sell refreshments to walkers passing through his family’s 6000-acre estate in Scotland. The Sheriff presiding said Edmonstone had ‘a long history of manipulative and sociopathic behaviour’.

Such were ideal personality traits, it seemed, for the venal dotcom world. It was always ‘other people’s money’ or ‘OPM’, as the wide boys termed it: it paid for the fees, it paid for the lunches, it paid the executives’ salaries until cash ran out. It bumped up the price of shares so promoters could sell them at a profit or cash out their warrants. Sharp operators set up deals where they not only raised money for the company but also sold investors shares that they had previously issued to themselves, usually ‘in return’ for the concept or their management efforts.

The bubble burst, or at least gradually deflated, soon enough. But we live in a financial world born of dotcom. Dotcom paid for the infrastructure that we take for granted today. The technical innovations of the late 1990s paved the way for contemporary high frequency trading and a different way of thinking about stock markets – the engineer’s aesthetic, not the traders. And the media circuit that grew out of dotcom exuberance, the claret-oiled machine in which I was a small and well-fed cog, marks the beginning of a distinctive cultural presentation of finance that has more recently manifested itself in Wall Street Bets-Gamestonk, Paris Hilton’s chihuahua immortalized in NFT, and dogecoin to the moon.

In the promoters’ rackets, though, there was nothing new. The structures of deals offered to dotcom investors in 1999 were often remarkably similar to those that had fed the early 20th-century rubber boom in Shanghai. The North China Herald reported that ‘all the small Smiths in town ran amuck … for five weeks brokers had their clothes almost torn off their backs by excited plungers who desired to buy shares forward at three or four hundred percent premium’. Capital from those small smiths funded the Malay rubber plantations where imported industrial production techniques drained the vitality of indentured labourers, themselves shipped from India in gangs. We can say similar things about the tech unicorns of today, those giant platforms that promise to liberate workers, when really the only freedom is theirs: from unions, taxes, and labour laws.

The spectacle of money to be made and worlds transformed by doing so, that isn’t new either.

At Shares Ross put me in charge of the mining beat. Being a child of 80’s Britain I thought this would be a dead end. Quite the reverse, it was a pageant, a spectacle; miners weren’t diggers but promoters and stock hustlers. I remember meeting one such, a genial and tweedy character, educated at Harrow and Oxford, the son of a distinguished parliamentarian. He was raising money from private investors to buy a dredger and exploration permits from an outfit in Brazil, run by a man called Harry. There was little in the way of documentation available for investors; all they had to go on was an eight-page report produced by a corporate finance adviser who himself sat on the board. The dredger was going to look for diamonds deposited in the rivers in a remote and bandit-infested part of Brazil. The promoter spun me yarns about guns and cowboys, precious stones and huge snakes. The one that stuck in my mind concerned a labourer swallowed by an anaconda; his fellow miners had to wait until he was completely past the snake’s head before they could lop it off and extract him. The firm soon enough discovered a serious problem with its contractor and cut its links. It kept the dredger, but shareholders did not keep their money.

When I started to learn about mining, everyone was talking about Bre-X, a monumental fraud perpetrated just a couple of years before. One reason that London’s mining sector came to prominence in the late 1990s is that Bre-X utterly destroyed the reputation of Toronto as a hub for exploration finance. The story is well worked over now, an exhausted seam. It has been given a scholarly treatment by the anthropologist Anna Tsing. The short version is that, in 1994 a small Canadian exploration company discovered, at Busang in Indonesia, what appeared to be the largest gold deposit in the world; that a speculative fever broke out, drawing in the savings of many North American small investors; that by late 1996, Bre-X was capitalized at $6 billion; that on 19 March 1997, the geologist in charge of the site fell 800 feet from a helicopter into the jungle, where his body was consumed by hogs before it could be recovered and identified (but not his Rolex, which somehow remained on the helicopter); and that, when the independent assayers finally arrived at the mine, they found no evidence of gold in the cores, none whatsoever, and determined that what gold the samples did contain had come from a river, not a rock. For all the excitement, the noise, the conspiracy stories, there was nothing. For Tsing, however, the absence of gold is almost immaterial to the whole affair. What matters is the spectacle, with the fake deposit likened to a film set: No one, she writes, would ever have invested in Bre-X if it had not created a performance, a dramatic exposition of the possibilities of gold.

By this meandering route, I would like to offer some reassurance for the present moment, for when scholars all around the world are wondering – wondering very deeply – what we can say about our brave new era, when capital dreams of Mars and meme coins; what we can say about spectacular markets, scam markets, excessive markets, paranoid markets, even?

Let us go back to the tools with which we set out on our very brief history of London’s markets: the un-building of the stock exchange, the disassembly of the networks of people, things and politics that comprise these institutions. Let’s set them to work. I’m thinking, perhaps, of a certain person inhabiting the very centre of American politics. Not the man, so much as the ‘collective delusion’: the spectacle, hurling insults and refusing to stand by them, preening on Saturday Night live or in the Oval Office; the rocketeer and Mars colonist carried on a wave of sheer make-believe money, dogecoin to the moon; the fact that he is a kind of hybrid of capital and fantasy and carnival, a CEO who is more meme and reddit chat than analyst briefing and dividend. Like Bruno Latour’s Pasteur, he is more than a man: an assemblage, a network, a mixing pot of culture, technology, performance and financialization.

We can unbuild the spectacle: take the time to disassemble the network, the performance, the points of passage through which the thing colloquially known as Daddy Elon comes into being. In doing so we might strip away the genius mythmaking and eventually reveal something really quite ordinary: trivial in every sense apart from its consequences. We might see also how fragile the network is, how quickly it can collapse, how the tipping point might be that Roman salute, or the public tweet from your pop star ex asking you to please pick up the phone and also, stop taking the kid to see Uncle Donald.

The reassurance is as follows. Over the last few years I have presented my research many times. Depending on my audience, I have tried to position it as a focus on the innovations and possibilities of finance, or on the diabolical expropriations of which it has been guilty. All these are valid. When I tell the stories, however, they always come out the same way. Often, they are just funny, the characters as eccentric and ridiculous as one might find in any other office or profession. Some are thoughtful and virtuous, some hardworking and dull, others vainglorious and hubristic. Sometimes things work, and sometimes they do not. That’s why I don’t want to tell you a story about how finance is always already awful, because it perversely solidifies the efficacy of the financial machine.

In my book, and this lecture a little, a young, naïve, plump version of me becomes an unwitting accomplice to various kinds of financial skulduggery. I aim to make space, to create a dissonance and uncertainty, to leave the sense that finance is not as clever as it thinks it is. On the contrary, finance is mostly quite ordinary, banal – God forbid, even dull.

Some things, of course, are so monstrous that they are beyond the tools of disassembly, or snark: dispossessions, enslavements, the current vampiric enervation of gig workers and delivery drivers. These are things to be mended by reconciliation and tackled by social action. Finance is a lever, the stock exchange its fulcrum, and as such it can work both ways; it is a social technology sustained by us, a mirror that shows our desires, hopes and fears. It is as much a part of modernity as industrial production, and in many ways the stock exchange is the factory of finance: we can choose between dark satanic mills and gleaming, safe and productive workplaces; between a finance that is oppressive and exploitative, or collaborative and mutually enriching. That choice is political, for us all to make; making it will summon the imagination to do things differently, to stay with the trouble, to get us all out of the mess we are so evidently in.

And speaking of getting out of trouble, what of my lawyer-banker-abolitionist ancestor? He may have voted against slaving in Parliament but when it came to it, like all the other Roscoes who followed him, he was terrible with money. He never pulled off the banking rescue and was himself declared bankrupt. He had to sell his art collection and vacate his country house. It’s now a family restaurant of the kind you take grandma on a Sunday. His dirty money went to his equally dirty creditors. On that account, at least, I am spared liberal guilt. Though I do wish he could have hung on to the Leonardo. Thank you very much.

In April, I was able to visit the Institute for Culture and Society, University of Western Sydney, and give the talk again. Thank you to Professor Gay Hawkins for the invitation, Dr Stephen Healey for a thoughtful discussion and everyone involved for their hospitality!