In January 2019 I started work on a podcast called “How to Build a Stock Exchange”. Production was intermittent (it’s very time consuming!) and I finally finished in the autumn of 2020, by which time the world looked quite different. Pandemic notwithstanding, the issues it tackles are as current and important as ever.

The podcast takes a leisurely tour through the history and sociology of financial markets, explaining how they work and how they come to be as they are. It generated plenty of attention – by academic standards at least. While the podcast is live, you can follow it on iTunes, Spotify and Stitcher, but I’m archiving it here along with the transcripts for a more permanent home. The references and sound credits, originally published with the full transcripts, are now available at the bottom of the page.

Enjoy listening! Please feel free to share and use them, but please acknowledge/cite when you do.

Episode 1. Finance matters. We’re off to build a stock exchange, but first of all I’ll spend a little time explaining why financial markets matter. This episode explores how financial markets – a crucial mechanism for the distribution of wealth – are implicated in our present political malaise and looks at some of the ways that finance has squeezed us over the last three decades.

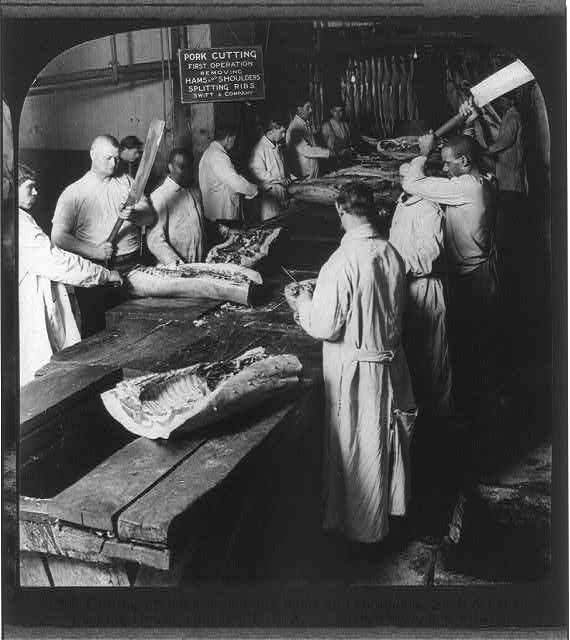

Episode 2. From pigs to prices: a Chicago story. How did Chicago’s stockhouses lead to one of the greatest financial markets on earth? This episode explores how commerce and technology shaped the founding of the Chicago Board of Trade and gave birth to financial derivatives. It tells how the telegraph transformed trading, how the pits functioned as human computers turning pigs into prices, and how when we come to build our stock exchange we’ll have to get a building to fit.

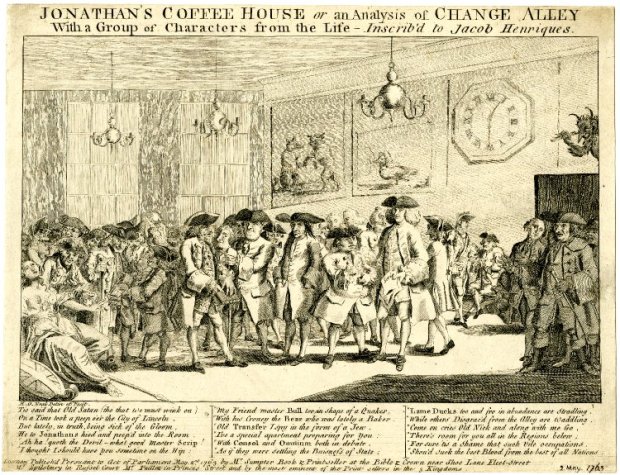

Episode 3. On Brexit and borrowing: the entanglements of markets and states. From King William III’s empty coffers in the eighteenth century to David Cameron’s ‘big, open and comprehensive offer’ in the twenty-first, penniless governments have had to go cap in hand to the markets. Stock exchanges have always been on hand to help out, though not at any price, and states have assisted by settling matters of morality and legality in the expanding domain of finance. This episode unpicks the complex relationship between markets and state and wonders whether there’s anything positive for our building project.

Episode 4. Pickles, public schoolboys, and the business of financing start-ups. This episode takes an anecdotal wander through the business of financing start-ups. Our guide is Sixtus, an old-Etonian who imported ‘business angel’ investing to the UK. Along the way, I’m waspish about public schoolboys, perceptive about pickles, explore the difference between equity and debt, and wonder whether stock markets must always be about those billion dollar valuations.

Episode five. ‘Mind your eye!’ Rules and rituals in the markets. Social interactions – rules and rituals, norms and codes of practice – are the glue that holds a stock market together. This was especially so in the open outcry markets of the twentieth century. The episode looks at the strange societies of Chicago’s pits and London’s ‘Old House’. What did it feel like to work on the trading floor or inch your way up the Exchange’s social ladder, where cockney sparrows and the old elite rubbed shoulders? A meritocracy of sorts, so long as you were a man. This episode contains some strong language.

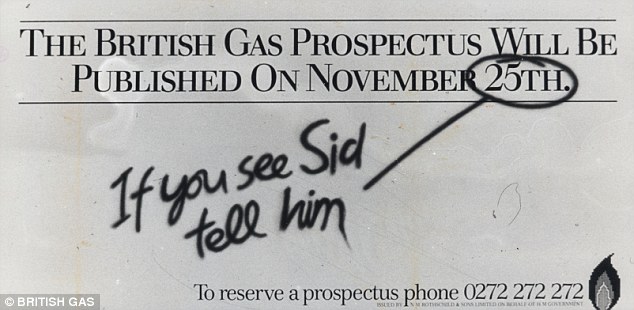

Episode 6. The decade when greed became good. We can’t make sense of contemporary stock exchanges without understanding the huge changes that swept through finance in the 1980s. This episode explores those upheavals at the level of states and markets, and the of lived reality of Britain’s markets: the collapse of Bretton Woods, the Iron Lady’s reforms, striking miners and a new kind of investor called Sid. This really was the decade when greed became good.

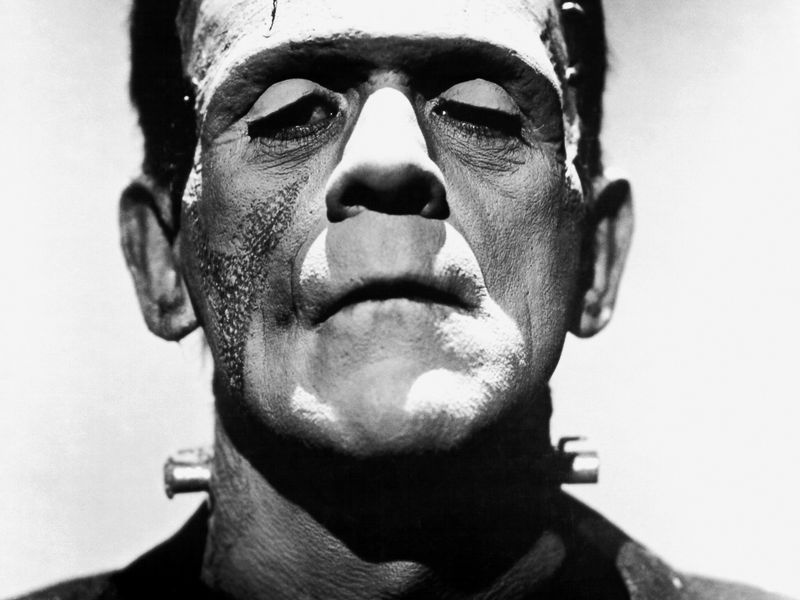

Episode 7. The new deals. 1980s Wall Street was as inventive as it was ostentatious. New kinds of deal turned the relationship between finance and society on its head: collateralized mortgage obligations made homeowners into raw material for profit, while the leveraged buyout allowed corporate raiders to tear up companies in the name of shareholder value, all this backed by the new science of financial economics. This episode takes a random walk around some of finance’s most rapacious innovations.

Episode 8. Wires! Modern stock exchanges couldn’t exist without wires. They are virtual, global, infinitely expanding. Their trading floors are humming servers. But no one ever planned this transformation, and it took many by surprise. This episode explores the long processes of automation throughout the second half of the twentieth century. We hear about engineers, screens, and how technology created a new stock exchange almost by accident.

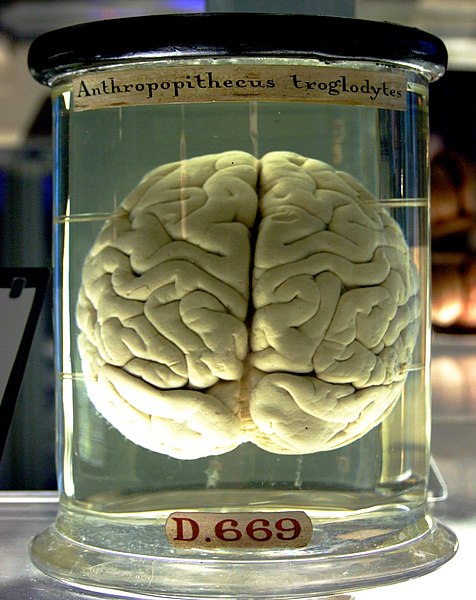

Episode 9. Finding prices, making prices. What’s in a price? This episode sets out to answer that question, via Joseph Wright’s Experiment on a Bird in a Pump, the construction of the London interbank lending rate, and some ruminations on the nature of fact. As for why it matters, we visit 80’s London for a tale of greed, sausages and a salmon pink Bentley.

Episode 10. Where real men make real money. Stories shape our world, and stock markets are no exception. This episode explores the entanglements of fiction and finance, from Robinson Crusoe to American Psycho. We discover how Tom Wolfe cut a deal with Wall Street, making finance male, rich and white, and see how the concept of ‘smartness’ perpetuates elitism and discrimination in Wall Street recruitment. A better stock exchange is going to need a better story; in this second half of my podcast series we’ll be discovering just that.

Episode 11. UK plc. In 1995 the London Stock exchange set up its junior market, AIM, an engine for UK plc. This episode explores how the narrative of entrepreneurial Britain brought this new market into being. That’s how the story goes, at least. The history turns out to be a little more complicated. This episode looks back to London of the mid 1990s, as a the country found itself transformed by the new dynamism of globalization. There’s a little bit of social theory, and in coming episodes we’ll be seeing stories through the eyes of a much younger me, so I get an introduction too. [Warning: some market vulgarity in this episode.]

Episode 12. The ‘High temple of Capitalism’. Some stories incarcerate, others emancipate. This episode explores the founding of the London Stock Exchange’s junior market, AIM. It follows the narrative of UK plc, exploring how it shapes the Exchange’s actions. We hear how the story slowly changes into something different, a vision of the market as the high temple of capitalism. We find out how the market makers and advisors lobbied successfully to maintain their advantages in the market. Despite all this, I suggests that we might find in the AIM story some germ of emancipation: a new way of understanding how a financial market could look.

Episode 13. Other people’s money. This episode returns to 1999, the year of dotcom mania to explore how rivers of cash from private investors – other people’s money – changed the shape of finance forever. OPM paid for new infrastructure, made finance mainstream in the media, and helped establish a stock exchange for small company stocks. Fortunes were made – even the Queen got involved – but not by these everyman punters. We start thinking about why these ‘other people’ invest at all, especially as they are so bad at it.

Episode 14. Seeing and doing in the market. What better week to tackle fear and greed in the stock market? Under the shadow of global financial meltdown, this episode explores the nature of cognition in the markets: how market actors see, choose and act. Moving from the model of homo oeconomicus in the efficient market to the irrational animal spirits of behavioural economics, I find neither satisfactory, and explore an alternative, sociological concept of decision: that it is distributed across social and technical networks. We revisit the non-professional investor, and find that a distributed model of decision making can help us understand their sometimes idiosyncratic actions. Updated with postscript!

Episode 15. Opportunity lost. This episode explores how the forces of globalisation reshaped London’s small company stock markets. We discover how a commodities boom led to a gold rush in financing resource firms, and tumble into the pitfalls of exploration financing. We see the old hierarchies of politics and capital reproduced in this new sector and witness the eventual downfall of OFEX, the market we have followed since its inception. Along the way we meet promoters, anacondas, and of course, diamonds. With strong language and heavy dudes.

Episode 16. Markets at the speed of light. This episode explores the technological transformations that have led to markets at the speed of light: algorithmic traders and flash crashes. Yet for all the images of terrifying AI we discover that stock markets in the cloud are more rooted in material than ever before, pushing against the laws of physics in the pursuit of speed and profit. We see a culture war between hoodie and suit, techie and yuppie, but find – no surprise here – that whatever the uniform, the elites win out in the end. [And apologies to Donald MacKenzie, whose title I have subconsciously plundered!]

Episode 17. White markets, black markets. This episode examines the racialized structures of finance. It sets off from the infamous Zong massacre and legal case of 1781 to explore the patterns of exploitation that underpin finance, and to show that contemporary finance is built on structures and practices established by eighteenth century slavery. It finds modern parallels in the speculative credit of the financial crisis and its legacy of austerity. There’s a personal narrative, as well, a family genealogy that circles the slave trade, winding up in the sometimes contradictory figure of the critical management academic.

Episode 18. How to build a stock exchange (at last). In this, the podcast’s last episode, I finally, absolutely, and almost completely definitively, tell you how to build a stock exchange (and who invented unicorns).

Notes and sound credits for the podcast: